CASH

One of the bullish arguments out there is that there is a lot of cash on the sidelines, and as soon as “investors” are comfortable, they will start buying stocks again. Well, I am not 100% sure that is the case as I have explained with all that is happening through Robinhood and online trading.

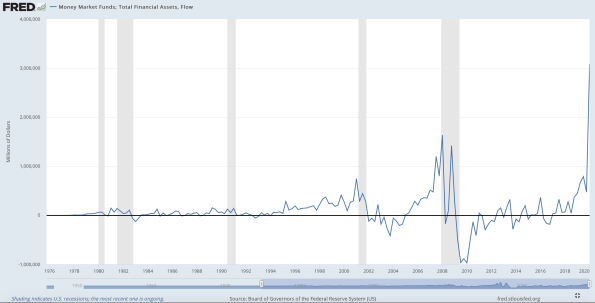

But here is a good chart. It actually shows money markets are at all-time highs (I think there are a lot of reasons, most of them related to extreme corporate borrowing over the past few months, so many companies are sitting on billions in cash. Some is at the bank. Some is in money markets, etc.). But here’s the catch: major recessions followed the last 2 peaks. Is this time different? And the current extreme is nearly double the past extreme in 2008. Does that mean a potential correction is significantly worse than we can imagine? Only time will tell.

GEOPOLITICS

With all the attention on COVID, social justice, unemployment and the stock market, geopolitical issues have been virtually ignored. Unfortunately, there are some developments that are concerning:

- China-US tension is growing: Trade, Virus, South China Sea

- Turkey and Greece are poking each other and talking about war (seriously…I’m not kidding)

- Middle east tensions are rising between Israel and everyone else

- Global trade volumes are 15% lower than last year, which is bad for everyone and countries are starting to voice their irritation with each other (China/South Korea, US/Everyone, Europe/Asia ex-China)

Pressure is mounting everywhere.

BIG 3

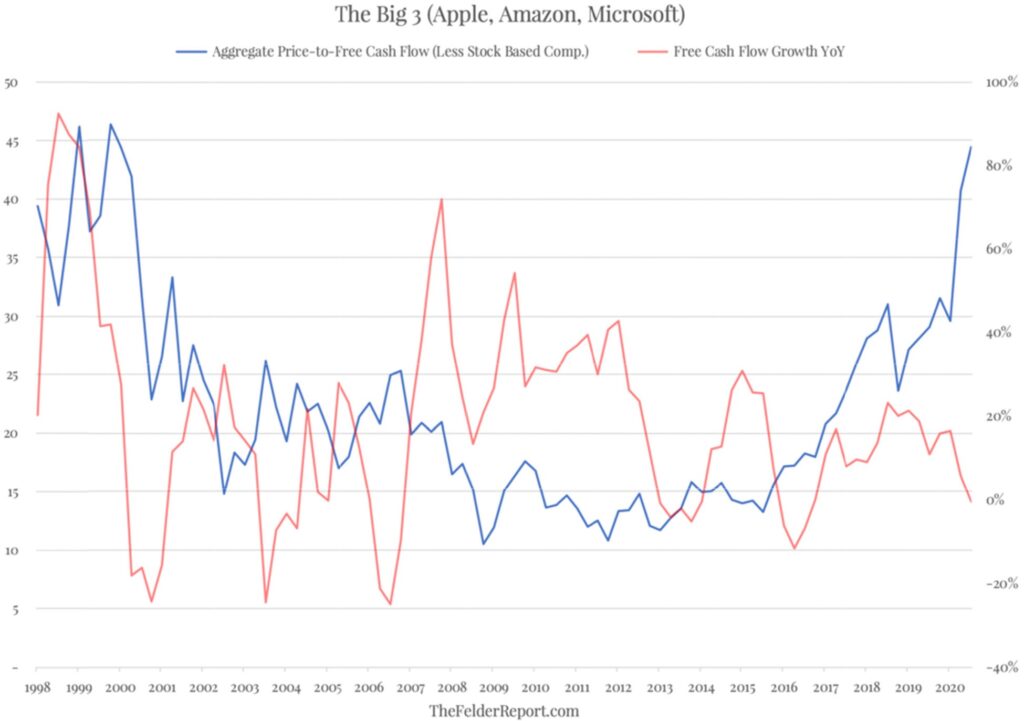

No, not the Big 3 automakers. I am talking about Apple, Amazon and Microsoft. The consensus is that these companies are untouchable. COVID will make them better and stronger and eliminate weaker competition. Not many have the nerve to come out and say they are over-valued, but they are. Just as in 2000 when there was a belief that technology companies should be viewed differently and permanently more valuable, we have the same arguments today.

Here is a great chart from The Felder Report

John Mauldin makes some quick and easy commentary about it, so I am not going to repeat him here. Just take a quick read in his latest commentary (https://www.mauldineconomics.com/frontlinethoughts/valuation-inflation)

Nuff said. Bubblicious. #ThisTimeIsNotDifferent…it’s worse.